COVID-19 has changed the lives of Americans in many ways. People have been laid off from jobs. They have been forced to shelter in place. Being quarantined with their spouses has been challenging for many people—so much so, in fact, that many are considering divorce.

However, the coronavirus crisis has made divorces more complex. Right now, courts are closed, opening only in emergency situations. Right now, divorces are not emergencies. In many cases, people are acting irrationally and trying to make decisions when they are in a stressful, unprecedented situation.

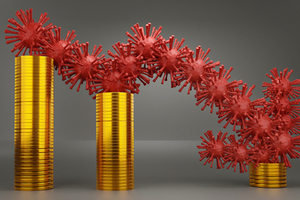

We are in a turbulent time right now. People are getting sick and dying. People are struggling to pay bills due to the economic downturn. Due to this economic downturn, you can bet that one aspect of divorce—property values—will be impacted greatly.

In a divorce, one of the first steps is to identify all marital assets and liabilities. Once everything has been identified, you will need to have them valued. A judge or the spouses will need to determine the fair market value (FMV) of each asset. The FMV is defined as what a seller would pay a buyer based on all the facts involved. However, the stability and predictability of the economy are two things that drive the value of assets. Therefore, judges may rely more on expert opinions at this time to determine the true value of your assets based on the COVID-19 pandemic.

Appraisers and accountants are used to determine the value of a home and other assets. However, this is more difficult nowadays with most of the country under shelter in place orders. Real estate agents and others in the home business are working remotely. This means that an appraiser may not even physically come to your home to do an assessment. They may rely solely on photos of your property or even the selling prices of homes in your area to arrive at an estimated value for your home. In addition, home prices are plummeting, since not many people are buying homes in these uncertain times.

Other assets are depreciating in value as well. Stocks have been plummeting for the past month. Many people have lost hundreds of thousands of dollars. This drop in value is something else that can impact your divorce.

What this means is that now is not the best time to divide assets. Homes and stock portfolios are at their lowest values in many years. You will not get as much as you expected if you opt to divorce now. Your best bet is to hold off on divorce until the economy improves. If you really want to divorce, another option is to finalize other aspects of your divorce and then finalize property division at a later date, such as later in the year when the stress caused by the pandemic dies down. This is because many businesses are closed right now anyway, so you can greatly improve the valuation of your assets simply by being patient and waiting.

If you do choose to wait, be sure to monitor assets and liability carefully. During the quarantine period, you want to ensure debts are paid up. Keep assets as intact as possible. Do not make any decisions about liquidating assets or taking on more debt during this time.

Collaboration is key right now. It is your best bet in order to avoid nasty battles that can make your divorce more costly and time-consuming. However, it is possible that you could have problems communicating effectively with your spouse during this time. If this is the case, get help right away from an attorney. Check into getting an emergency court order to protect your assets and ensure they are not liquidated during this time.

What if You Want to Divorce Now?

If you just cannot wait and want to start the divorce process now, including the property division aspect, here are some things to consider:

- Divide assets by percentages rather than dollar value. Consider splitting 50/50 or some similar split rather than by dollar amount. This makes things less risky in case you value an asset at an unrealistic dollar amount.

- Consult with a lawyer for advice on complicated assets. It can be difficult to evaluate some assets, such as a small business that may shut down due to the pandemic. An attorney can advise you on methods you can use to value that asset post-divorce.

- Have an agreement in place for jointly owned property. If you and your ex-spouse plan to continue to own jointly after the divorce, make sure your settlement agreement includes a Property Management Agreement. This agreement should include conditions for a future sale, as well as each spouse’s responsibilities for taxes, insurance, utilities, maintenance and repairs.

- Alimony may or may not be modified. Payments can only be modified if there is a change in circumstances. However, in some cases, it cannot be increased, so keep this in mind, especially if you expect to receive alimony.

Seek Legal Help

We are seeing an economic downturn as millions of Americans have been laid off. Assets are being devalued, so if you want to get your fair share in a divorce, ideally you should wait until the economy improves.

COVID-19 is making divorces more complicated in many ways. Get the help you need from Broward County divorce attorney Scott J. Stadler. He can give you financial advice so you can get the best outcome in your divorce. Schedule a consultation today by calling (954) 346-6464.